Morning star pattern in Forex

Change video quality to 1080p HD

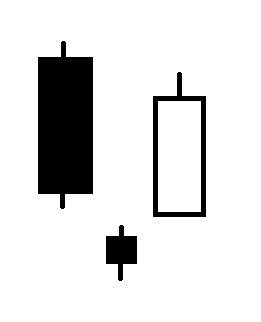

Morning star pattern is a three-candle formation that is made up of the following candles:

Morning star pattern is a three-candle formation that is made up of the following candles:

- First is a strong black candle

- Second is a spinning top or a candle with a small real body who’s colour does not matter

- Last is a strong white candle

The morning star pattern appears at the bottom of a down-trend so its purpose is to turn the current down-trend around in the upwards direction.

The rule of the morning star patter is as follows:

- The first candle has to be a strong black candle

- Second candle has to be a small spinning top that opens and closes at or below the first, black candle’s close

- Lastly, the third candle has to open at or above the second candle’s close and close more than half way into the first, black candle’s real body

If the third, white candle closes at a price level below the mid-point of the first, black candle’s real body, the pattern does not qualify as a morning star.

In the chart below, we can see that the down-trend was halted by the appearance of the morning star pattern. After its appearance, the market changed direction as the bulls regained control.

The appearance of the morning star pattern turns the market focus around to the upwards direction.