Difference between fixed spreads and variable spreads in Forex

Change video quality to 1080p HD

In this video tutorial we discuss the difference between two types of spreads – fixed spread and variable spread. Various Forex brokers use both versions so it is worth knowing the difference between the two.

Every time that you trade you will be offered a bid and an ask price. In other words these are the selling and buying prices. The difference between the two prices is called the ‘spread’.

Fixed spreads

If you are using a fixed spread broker your spread will remain the same no matter how volatile the market is. For example, if your Forex broker is offering a 1 pip spread on a currency pair and you are trading $1 per pip, your trade will need to move 1 pip into your trading direction so that you break-even. The 1 pip move will equate to a $1 gain. If you are trading $2 per pip then you will still need a 1 pip move into your trading direction but this time that will equate to $2, and so on.

Variable spreads

Variable spreads are slightly different and in fact; many more Forex brokers are using them nowadays. The main difference here is that spreads change during the trading day according to market volatility. For example, they can be much wider at periods of high volatility and also when the market is really quiet, say after 16:30 Greenwich mean time on a Friday; when volume dramatically decreases.

So, they are wide when we have huge trading volume and also when markets have hardly any volume so that Forex brokers decrease their risk. That is, if you place a trade during exceptionally high volume periods when prices move quickly, markets tend to spike and therefore you can make a high profit. This puts the broker at risk so they widen the spread. On the flip side, if you place a trade during exceptionally low volume periods when prices hardly move chances are that you are not going to make a huge profit but brokers widen out the spread to make sure they make even more then they would normally. Even if you decide to close the trade and make a small loss because prices are hardly moving, the Forex broker still makes money from you.

‘Too wide’ spreads

Forex brokers that you have to be careful of are those that use high volatility periods to hunt your stop. If unexpected news comes out we tend to see huge market spikes or drops. At these times some brokers widen out their spread so much that the end result will most likely be the taking out of your stop. As explained above, they do this because they are at a high risk of losing money so they widen their spread out to guarantee they make some instead. They will call this risk management but don’t fall for this. There are plenty of honest brokers out there that do this efficiently and do not put your stop at risk but these ‘high spread’ brokers are not one of them.

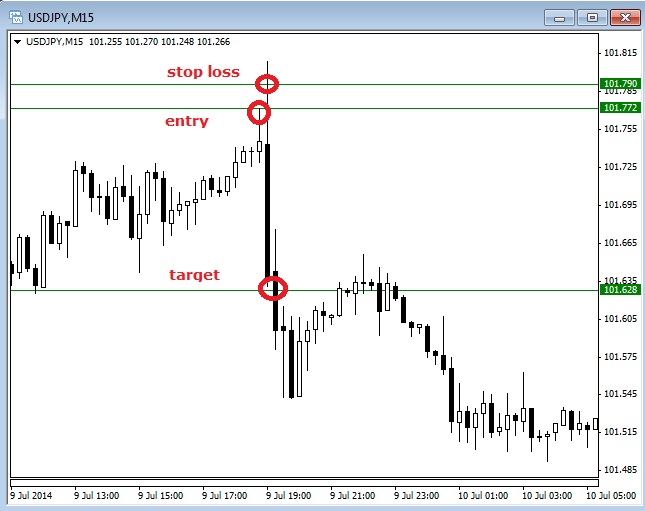

In the above chart we can see a big drop in market prices which indicates that some unexpected data has been released and thus pushed the market downwards. Let’s say our entry was at 101.772, our stop loss is just a few pips above at 101.790 and our target is at 101.628. We are obviously trading downwards in this example.

If we were trading in true market conditions then our stop loss would have been hit. This is fair. Unfortunately we got in short too early on this occasion.

However, if we were trading in unfair market conditions where the broker had widened their spread, our stop loss would have been hit unfairly. There is no reason for those prices to spike up in the upwards direction and take us out. The market is not doing this, it is the broker. It is even more frustrating to see prices drop in the initially traded direction, after this event.

To ensure your Forex broker is not trading against you in this manner you need to have another one or two more brokerage accounts. The reason why is that this allows you to compare charts at times of high volatility. If you see that the charts don’t match then your broker is trading against you; you need to dump them. If they’ve done it once they will do it again and you will lose money for being right about the market. This is a sure sign that they are hunting your stop to take you out of the market and that is how they make money from you. So, it pays to be a bit more careful and resourceful when testing this notion. By comparing charts from various brokers you will most certainly find the right one for you that has fair spreads, whether they are fixed or variable.