Bearish engulfing pattern in Forex

Change video quality to 1080p HD

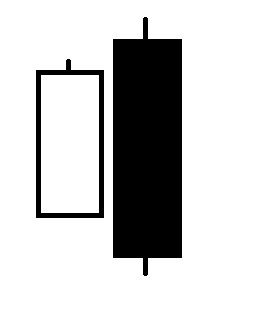

Bearish engulfing pattern is the opposite to the bullish engulfing pattern. It also comprises of two candles:

Bearish engulfing pattern is the opposite to the bullish engulfing pattern. It also comprises of two candles:

- First candle is a white candle

- Second candle is a bigger, black candle that engulfs the prior, white candle

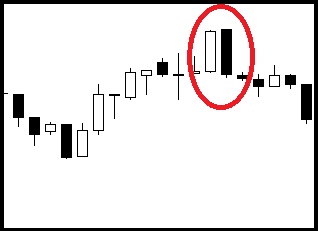

Bearish engulfing pattern occurs at the top of an up-trend. Its purpose is to turn the current up-trend around, into the downward direction.

The rule with the bearish engulfing pattern is that the second, black candle’s body has to engulf/cover the prior, white candle’s body. It does not have to engulf the white candle’s wicks. The white candle can be in any format i.e. doji, spinning top etc. The main rule is that it is engulfed by the black candle.

Do not place a ‘sell’ every time you see a bearish engulfing pattern. The reason why is because this type of pattern occurs regularly and a lot more confirmation is required for you to take the trade. We do not rely on the appearance of the bearish engulfing pattern alone because it can provide with a 'fake' impression that the market is turning.

In the chart above, we can see that the current up-trend looked strong, especially with the appearance of the strong white candle at the top.. However, the appearance of the strong, black candle forms a bearish engulfing pattern and the market turns downwards.