Piercing pattern in Forex

Change video quality to 1080p HD

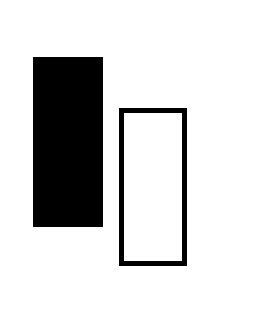

Piercing pattern is a two candle formation that comprises of the following candles:

Piercing pattern is a two candle formation that comprises of the following candles:

- First is a strong black candle (shadows should be small or non-existent)

- Second is a strong white candle

The piercing pattern always appears at the bottom of a down-trend. It is its purpose to turn the current down-trend around, in the upwards direction.

The rule with the piercing pattern is that the 2nd, white candle has to open at or below the prior, black candle’s close. It also has to close more than half way up the black candle’s real body. If it closes anywhere below the middle point of the black candle’s body, the formation then does not qualify as a piercing pattern.

What you must not do is place a ‘buy’ every time a piercing pattern appears. This is because this type of pattern occurs regularly and a lot more confirmation is required in order to trade it.

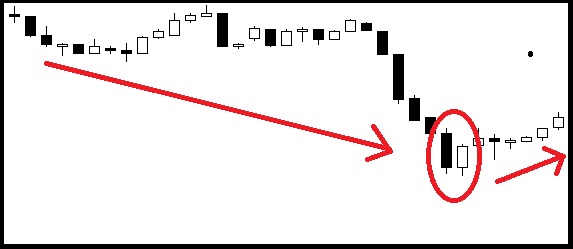

In the Forex trading chart below you can see that the market was suffering from a down-trend, especially in the latter part with the appearance of numerous, strong black candles. At this point the bears had full control of the market. However, the appearance of a white candle that opened below the prior, black candle’s real body and closed more than half way into the black candle’s real body completed a piercing pattern. It is after this point that bulls took control of the market and the trend reversed into the upward direction.

The appearance of the piercing pattern turns the down-trend upwards.