Dark cloud cover pattern in Forex

Change video quality to 1080p HD

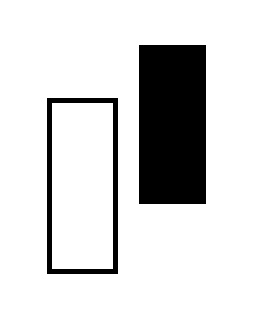

Dark cloud cover pattern consists of two candles:

Dark cloud cover pattern consists of two candles:

- First is a strong white candle (with small or non-existent shadows/wicks)

- Second is a strong black candle

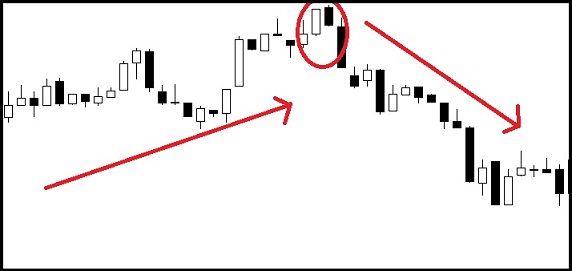

The dark cloud cover pattern is the opposite of the piercing pattern and therefore appears at the top of an up-trend. Its sole purpose is to turn the current up-trend around, in the downwards direction.

The rule with the dark cloud pattern is that the second, black candle has to open at or above the prior, white candle’s close. It also has to close more than half way into the prior, black candle’s real body. If the close of the black candle is at any price level above the half way point of the white candle’s real body, then the pattern does not qualify as a piercing pattern.

You must not place a ‘sell’ every time you see a dark cloud cover pattern. The reason why is because this type of pattern occurs regularly in the market and a lot more confirmation is required for you to trade it.

In the chart below, we can see that the up-trend is suddenly stopped by the appearance of a dark cloud cover. After its formation, the trend changes directions as the bears seize control.

Dark cloud cover pattern has the power to turn the market around.