Evening star pattern in Forex

Change video quality to 1080p HD

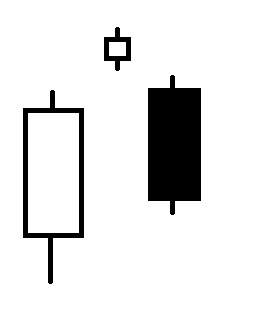

Evening star pattern is a three-candle formation comprising of the following candles:

Evening star pattern is a three-candle formation comprising of the following candles:

- First is a white candle

- Second is a small spinning top who’s colour does not matter

- Last is a strong, black candle

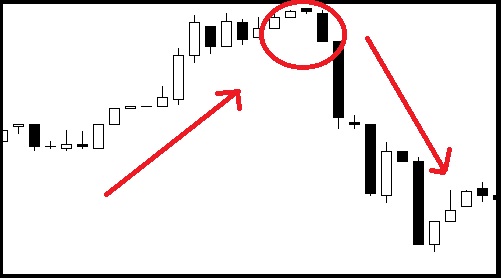

The evening star pattern is the opposite of the morning star pattern and appears at the top of an up-trend. This pattern has the power to turn the current up-trend into the downwards direction. The rules for the evening star pattern are as follows:

- First candle has to be a white candle

- Second candle is a small spinning top with small shadows/wicks that opens and closes at or above the prior, white candle’s real body. The shadows/wicks can overlap and do not matter.

- Third candle is a black candle that opens at or below the second candle’s close and closes more than half way into the first, white candle’s real body.

Do not place a ‘sell’ every time you see the evening star pattern. This pattern appears regularly and more confirmation is needed if we were to consider taking a trade at this point.

The chart below shows how the up-trend is strong until the formation of the evening star pattern. After its competition, the market mood turned sour causing a fall in price levels.

The appearance of the evening star pattern turns the trend downwards.