Doji candle in Forex

Change video quality to 1080p HD

The doji candle is a very significant candle when analysing trend reversals. It is not a reversal candle on its own but it does represent a weakness in the current trend taking place. The reason why is because it suggests that there is an equilibrium between buyers and sellers due to the open and the close being at similar levels. No side is strong enough to beat the other at this stage.

Logically, if it appears at the top of an up-trend it can signal that bulls are losing their strength and if it appears at the bottom of a down-trend it can suggest that the bears are losing their power.

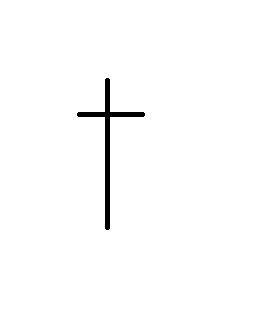

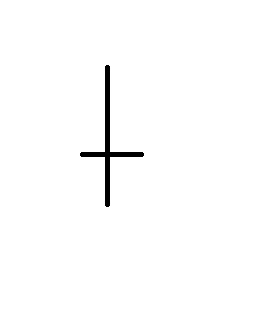

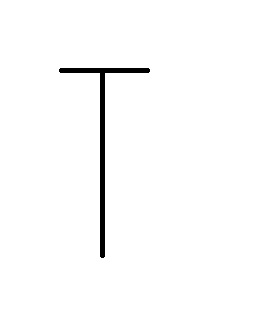

The doji candle comes in many formats but the main four formats are:

Stadnard doji Upside down doji

Dragonfly doji Gravestone doji

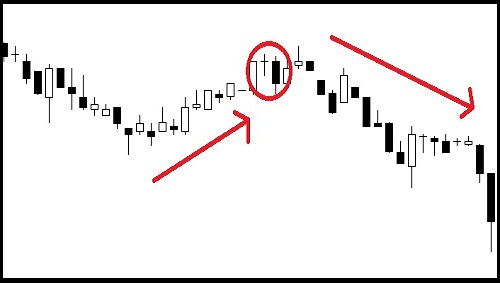

You must not place a 'buy' or a 'sell' every time a doji candle appears. The reason why is because the doji candle requires stronger confirmation such as a strong white or black candle after it, to suggest a likely trend reversal.

In the chart below, we can see that the appearance of the doji did not reverse the up-trend into the downwards direction. It was the confirming black candle that was the catalyst for the reversal.

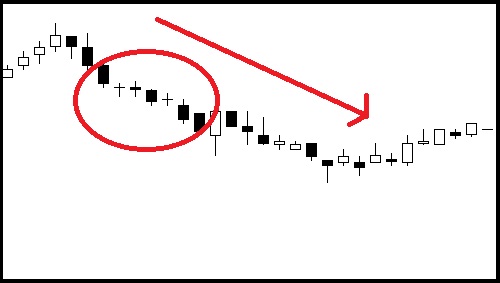

However, in the chart below we can see that even the appearance of multiple dojis did not turn the down-trend back up in the upward direction. There was simply not enough confirmation after the doji candles to hint at the decrease in strength from the bears.