Morning doji star pattern in Forex

Change video quality to 1080p HD

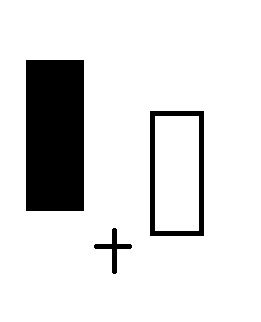

Morning doji star pattern is a three candle reversal formation that comprises of the following candles:

Morning doji star pattern is a three candle reversal formation that comprises of the following candles:

- First candle is a black candle

- Second is a doji candle who’s colour does not matter

- Last is a white candle

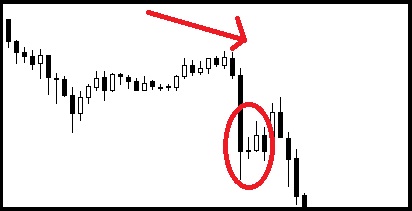

Morning doji star pattern appears at the bottom of a down-trend. Its purpose is to turn the current down-trend around into the upwards direction. In terms of its structure the candle formation has to be as follows:

- First candle has to be a black candle

- Second candle has to be a doji candle and can open and close below the first, black candle’s close. This is not required, it is simply preferred i.e. the doji candle can open and close above the black candle’s close.

- Third candle has to close above the first, black candle’s close. The higher the close the stronger this pattern is. We tend to look for a close that is more than half way into the first, black candle’s real body.

You must not place a ‘buy’ every time you see a morning doji star pattern. This is because this pattern appears quite regularly and more confirmation with a help of a few indicators (for example) is required in order to take the trade.

Below, we can see that the market was falling but the appearance of the morning doji star pattern had weakened the bears’ power. After its appearance, the morning doji star pattern turned the trend in the upwards direction. However, was it a stron reversal?

We can see that the morning doji star pattern had turned the trend around but this was short lived. After a few sessions, the trend continued to fall downwards. On this occasion, the pattern was weak, despite turning the trend around for a few sessions. The reason is that the white candle did not close more than half way into the first, black candle's real body, hence it has weakened the pattern.