Trading MACD indicator in Forex

Change video quality to 1080p HD

)

MACD is an abbreviation of Moving Average Convergence Divergence. To understand fully how this indicator works, we firstly must define what both convergence and divergence means.

Convergence – an identical relationship between the MACD and prices. If MACD and prices rise at the same time we have convergence. If they both decrease at the same time we also have convergence.

Divergence – an opposite relationship between MACD and prices. In an up-trend; when prices are making new higher highs and MACD is making lower highs, we have divergence. In a down-trend; if prices are making lower lows and MACD is making higher lows, we also have divergence.

With the above definitions in mind it is very clear why we use convergence to trade trends and we use divergence to trade reversals.

This technical indicator also includes a signal line. This signal line is a 9 period moving average which is incorporated into the standard setting for MACD of 12, 26 and 9. We also have a ‘0’ line which separates the MACD histogram bars and creates a higher and a lower region.

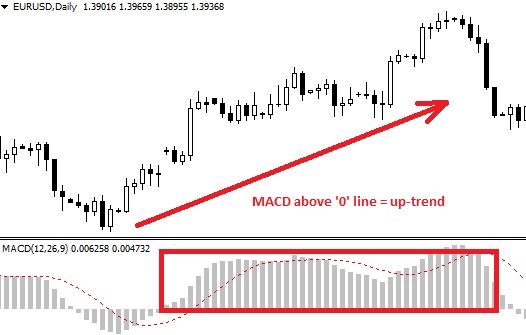

Using MACD convergence to trade trends

In this trading style the only factor we need to define is the positioning of the MACD histogram bars. We simply need to ask ourselves – are they above or below the ‘0’ line? If they are above, the market tends to be trending upwards and if they are below, the market tends to be trading downwards. Obviously, when the trend is coming to an end the histogram bars will start retracting their way back towards the ‘0’ line, no matter which direction the market was trending into.

As the histogram bars crfoss over the '0' line and move upwards, so do the prices

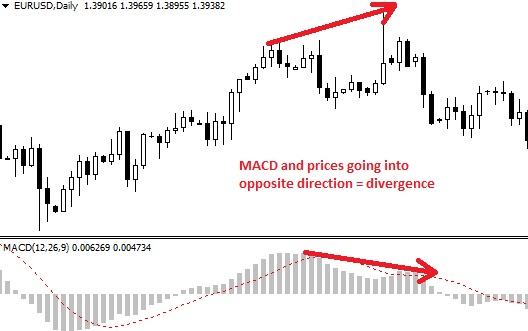

Using MACD divergence to trade reversals

This trading style allows us to recognize weakness in a current trend. For example, when we have an up-trend we usually see higher highs created in the price chart. However, if the MACD is making lower highs it is showing weakness in that trend. This is when we use the MACD to get into a reversal position. The opposite relationship between the indicator and price is the divergence we have been looking for.

Opposite direction between price and indicator creates divergence

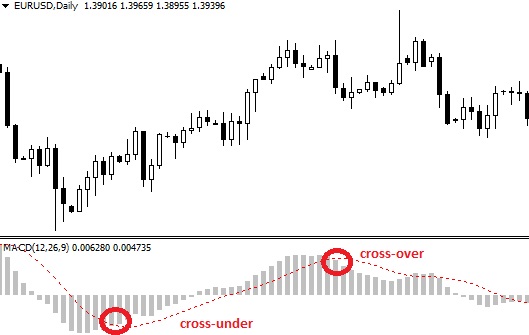

Using MACD cross-over to get into trends earlier

At some point in the trading session the signal line (9 period moving average) will be placed within the histogram bars. Once the signal line makes its way outside of the bars we call that the cross-over. This can be a very good signal to get into a reversal trade which we have caught early. Realistically, when we trade a down-trend reversal into the upward direction we are waiting for a ‘cross-under’ as the signal line comes from the opposite direction.

The cross-over can provide early entry signals

One thing you must remember with all Forex technical indicators is that indicators alone are not enough to take a trade. Prices are the number one indicator and the technical indicators are the confirmation tools which are used as part of the strategy.