Trading Moving Averages in Forex

Change video quality to 1080p HD

Moving averages can be great indicators that show us if a trend is taking place whilst also providing support and resistance levels. This is why they are amongst the most popular Forex indicators available to traders.

For those that are new to trading, the MA calculation is quite simple. The system will add together the closing prices of an ‘x’ number of trading sessions to generate a total and then divide that total by the number of ‘x’ trading sessions. For example, when using the 20 period moving average, the system will add the closing prices of the last 20 trading sessions to generate a total and then divide that total by 20. Obviously, when using the 10 period moving average the number of trading sessions considered in the formula will be 10.

Simple and Exponential moving average

Moving averages come in 2 formats; the simple and exponential. A simple moving average is a standard calculation that gives an equal weight to all trading sessions when the system is calculating the formula. So, when we use a 20 period MA the end result represented by the MA line is the TRUE average of those 20 trading sessions.

Exponential moving average does the same thing as the simple moving average but gives more weight to last few trading sessions. It is because of this that the MA line becomes more responsive to quick and large changes in market prices i.e. the MA line moves with the market changes.

Using moving averages to trade trends

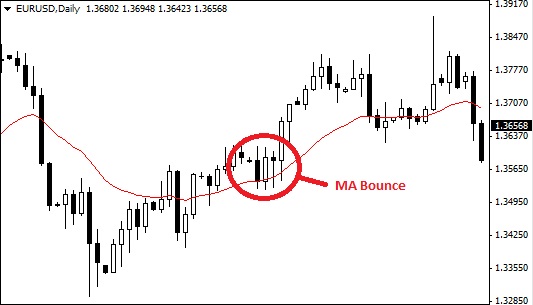

The most popular way of trading with MA’s is by using the MA line as a bouncing tool. For example, when we have an up-trend the MA line should be sloping upwards. Once prices decide to take a ‘break’ from the uphill advancement they tend to touch the MA line. If the MA line is still sloping upwards we have an opportunity to get into the trend, once prices ‘bounce’ of the MA line. The target is simply the previous high.

Prices tend to bounce of the moving averages line when trending

The moving average cross-over

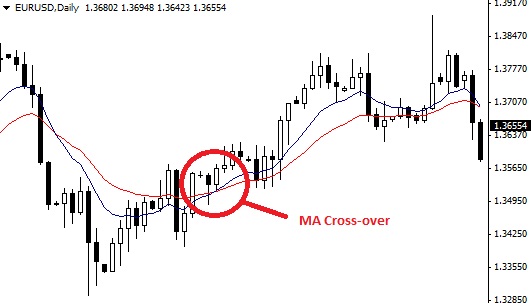

The other way of using moving averages is by looking for the ‘cross-over’. For that we need two moving averages in the mix - for example, 10 and 20 MA. Once we see a rise/trend in price levels we look for the 10MA to cross over the 20 MA. If we are trading downwards we need the 10MA to cross UNDER the 20 MA. The appearance of the cross-over/under confirms that a trend is current and ready to be traded.

The cross-over is sign that a new trend is forming

For a great example of how the moving averages cross-over can be used in unison with other indicators please watch our Commodity Channel Index video tutorial.